Not known Incorrect Statements About Private Schools Debt Collection

Wiki Article

Little Known Facts About International Debt Collection.

Table of ContentsExamine This Report about Private Schools Debt CollectionThe Ultimate Guide To Private Schools Debt CollectionPrivate Schools Debt Collection for DummiesTop Guidelines Of Personal Debt CollectionThe Greatest Guide To Dental Debt Collection

Discover more regarding how to detect financial debt collection frauds. You can ask a collector to quit contacting you as well as dispute the financial debt if you think it's inaccurate. If you perform in fact owe the financial obligation, there are three standard methods to pay it off: consent to a settlement strategy, clean it out with a single payment or bargain a negotiation.

The collection agency can not tell these people that you owe cash. The collection agency can get in touch with another individual just when.

It can, yet does not need to approve a deposit plan (Business Debt Collection). An enthusiast can ask that you write a post-dated check, but you can not be required to do so. If you give a debt collection agency a post-dated check, under federal legislation the check can not be transferred prior to the day composed on it

The best debt enthusiast task descriptions are succinct yet compelling. Once you have a strong first draft, examine it with the hiring manager to make sure all the info is precise and also the demands are strictly vital.

Facts About Business Debt Collection Uncovered

The Fair Financial Obligation Collection Practices Act (FDCPA) is a government legislation applied by the Federal Profession Payment that protects the legal rights of customers by restricting particular methods of financial debt collection. The FDCPA applies to the techniques of debt collection agencies and also lawyers. It does not apply to financial institutions that are attempting to recoup their very own financial obligations.

The FDCPA does not apply to all financial obligations. It does not apply to the collection of company or business financial debts.

It is not intended to be legal guidance concerning your particular issue or to replacement for the guidance of a lawyer.

The 9-Second Trick For Business Debt Collection

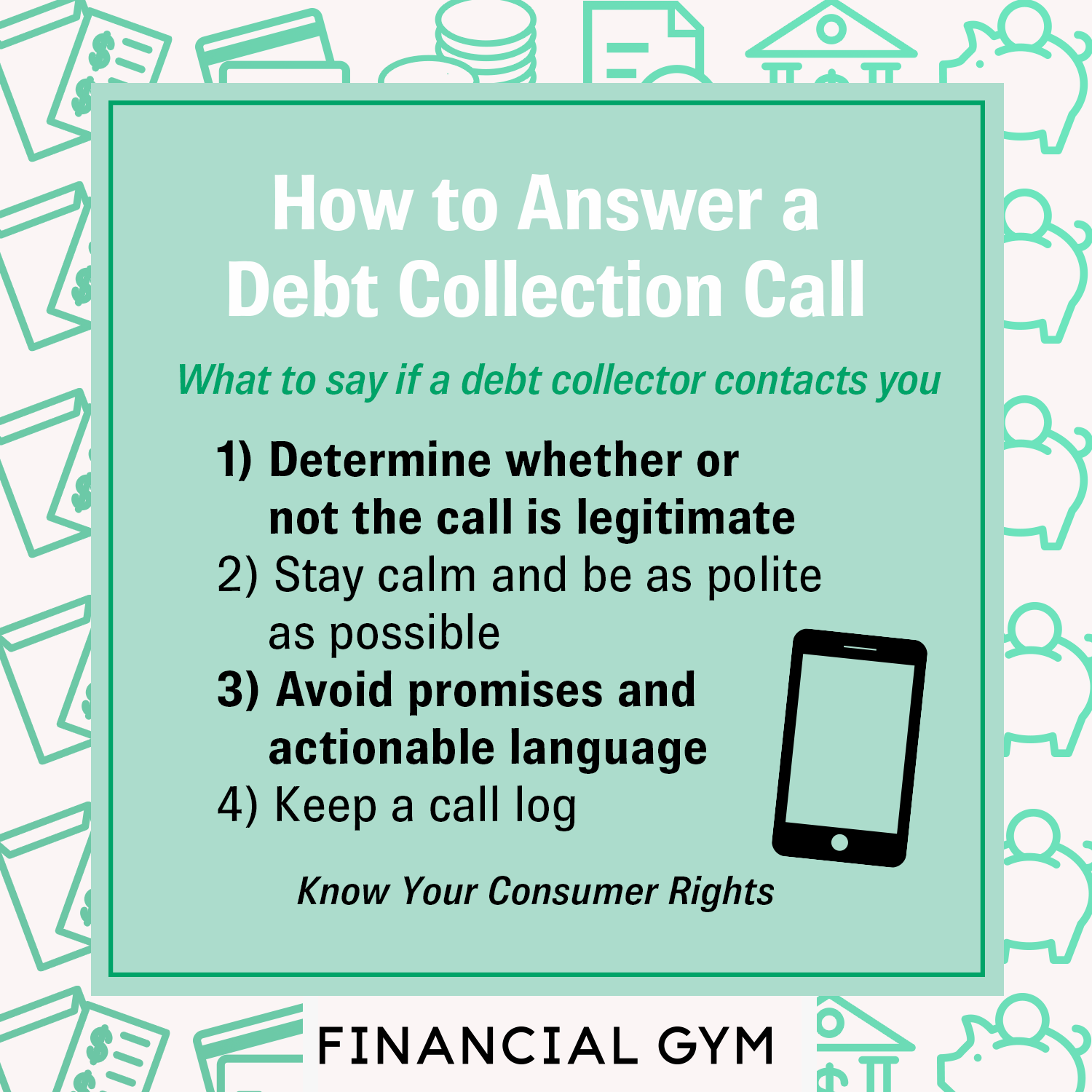

Personal, household and also family financial debts are covered under the Federal Fair Debt Collection Act. This includes money owed for medical care, revolving charge account or vehicle purchases. Business Debt Collection. A financial debt collector is any person besides the creditor who frequently collects or tries to collect debts that are owed to others which arised from consumer transactionsWhen a debt collection agency has actually notified you by phone, he or she must, within five days, send you a created notification revealing the amount you owe, the name of the financial institution to whom you owe cash, as well as what to do if you challenge the financial obligation. A financial obligation collector might NOT: pester, suppress or abuse anyone (i.

You can quit a debt collection agency from calling you by composing a letter to the debt collection agency informing him or her to stop. Once the agency receives your letter, it might not contact you once again except Home Page to inform you that some certain activity will certainly be taken. A financial debt collector may not call you if, within 30 days after the collection agency's very first contact, you send the collector a letter specifying that you do not owe the cash.

Personal Debt Collection Fundamentals Explained

This product is readily available in alternative style upon demand.

Rather, the lender might either enlist a company that is hired to gather third-party financial obligations or sell the financial debt to a debt collector. Once the financial obligation has actually been offered to a financial debt debt collector, you may start to obtain phone calls and/or letters from that company. The financial obligation collection market is greatly managed, as well as debtors have numerous rights when it get more involves dealing with costs collection agencies.

Despite this, debt enthusiasts will certainly try everything in their power to obtain you to pay your old financial obligation. A financial obligation collection agency can be either an individual person or an agency. have a peek at these guys In either case, their task is to gather overdue financial obligations from those who owe them. In some cases referred to as collection experts, a private debt collector might be in charge of several accounts.

Financial obligation debt collector are hired by creditors and are typically paid a percentage of the amount of the financial obligation they recover for the financial institution. The percent a debt collector fees is commonly based upon the age of the financial obligation and the quantity of the financial debt. Older financial obligations or higher financial debts might take more time to collect, so a debt collection agency could charge a higher percent for collecting those.

Some Known Factual Statements About Dental Debt Collection

Others work with a contingency basis and only charge the creditor if they are effective in gathering on the financial debt. The debt debt collection agency gets in into an agreement with the creditor to gather a percent of the debt the percent is stipulated by the lender. One financial institution may not want to choose much less than the complete amount owed, while an additional might approve a settlement for 50% of the financial debt.Report this wiki page